As the end of the financial year (EOFY) approaches on June 30 in Australia, businesses need to prepare meticulously to ensure smooth closure of their financial accounts. EOFY can be daunting, but with the right tools and resources from okke, you can manage this critical period with ease and precision. Here’s a comprehensive guide on how okke can help you streamline your EOFY tasks.

Understanding the Importance of EOFY

EOFY is a significant time for businesses as it marks the conclusion of the financial year. This period involves finalizing accounts, preparing tax returns, and meeting various compliance requirements. It’s an opportunity to assess the financial health of your business and plan strategically for the upcoming year. Proper preparation and management during EOFY ensure that you remain compliant with tax regulations and are well-positioned for future growth.

Essential Steps for EOFY Preparation with okke

- Initiate Preparations Early

Begin your EOFY preparations well before June 30 to avoid the last-minute scramble. Use okke’s robust reporting tools to monitor your financial data throughout the year, ensuring accuracy and completeness. - Maintain Accurate Financial Records

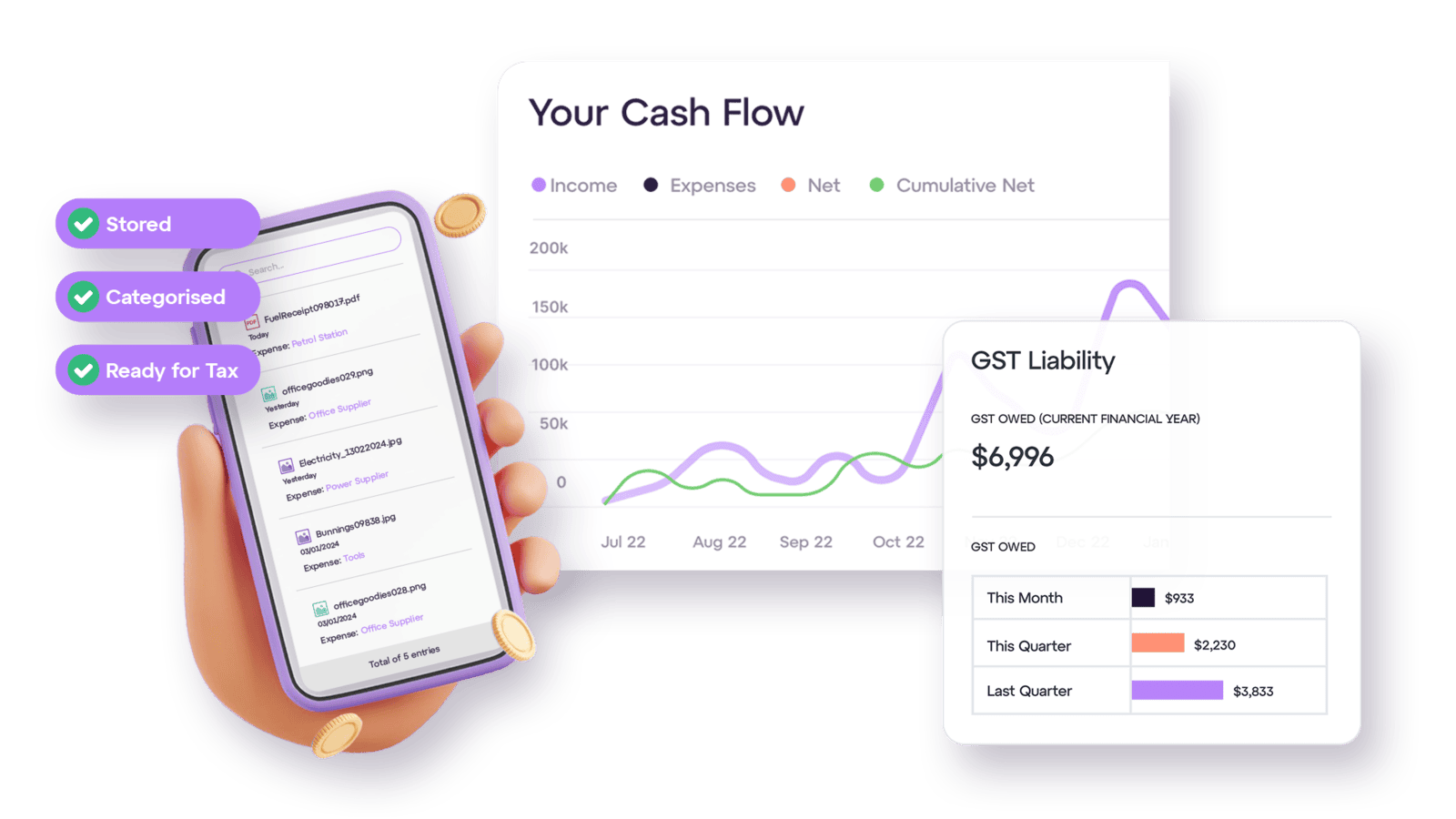

Accurate record-keeping is crucial. okke’s intuitive platform allows you to keep track of your income, expenses, and overall financial performance effortlessly. Regularly updating your records ensures that your financial data is precise when it’s time to finalize your accounts. - Understand Your Tax Obligations

Familiarize yourself with your specific tax obligations. okke offers a wealth of resources and tools to help you understand and meet these requirements. This includes guidance on deductions and expense management. - Utilize okke’s EOFY Tools and Resources

okke provides a suite of tools designed specifically for EOFY, such as:

• Tax Return Preparation: Comprehensive guides and automated features to help you prepare and file your tax returns accurately.

• Connected Bank: Effortlessly connect your bank account to easily reconcile transactions

• Expense Tracking: Easily track expenses to ensure all deductible items are recorded. - Decode Financial Jargon

okke’s jargon buster simplifies complex financial terms. Understanding terminology like PAYG (Pay As You Go) and other EOFY-specific jargon can make the entire process less intimidating.

How okke Supports Small Businesses During EOFY

okke is tailored to meet the unique needs of small businesses. Its online accounting software simplifies various EOFY tasks, from invoicing and expense management to payroll and compliance. The user-friendly interface ensures that even those without a financial background can navigate the system effectively.

Key EOFY Resources Provided by okke

okke offers a range of resources to help you navigate EOFY smoothly:

- Important Dates and Deadlines: Stay informed about crucial dates to ensure timely submission of tax returns and other financial documents.

- Detailed Financial Reports: Generate comprehensive reports to get a clear picture of your financial status.

- Step-by-Step Tax Return Guidance: Follow detailed instructions to complete your income tax return accurately.

- Record Keeping Best Practices: Learn how to retain and manage business records effectively to comply with legal requirements.

Running Your Business Efficiently with okke

okke equips you with everything you need to manage EOFY effortlessly:

- Efficient Invoicing: Streamline your invoicing process and improve cash flow.

- Accurate Bank Reconciliation: Automatically import and reconcile bank transactions for precise financial records.

- Easy Check Capture: Quickly capture and process checks to keep your accounts updated.

With okke, handling EOFY becomes a straightforward and stress-free task. Start using okke today and ensure your business’s financial health is in excellent shape as you move into the new financial year.