Exciting News:

okke joins the Reckon Accounting Software family

Save time, reduce hassle, and focus on growing your business

okke offers all the features you need without limits on invoices, customers, or your earnings. Spend less time and money on bookkeeping, and focus on what you do best – growing your business.

I still remember those dreadful hair-pulling, caffeine-inducing half-a-day quarterly spreadsheet rituals. Now, it’s just me, okke and a breezy 20 minutes.

Chau L.

Pixel HeroFriendly price - that makes sense.

Sign up today.

$19/month

All-in-one accounting for sole traders and solo business owners.

Unlimited support. Cancel anytime.

$209/year

All-in-one accounting for sole traders and solo business owners.

Unlimited support. Cancel anytime.

Key features:

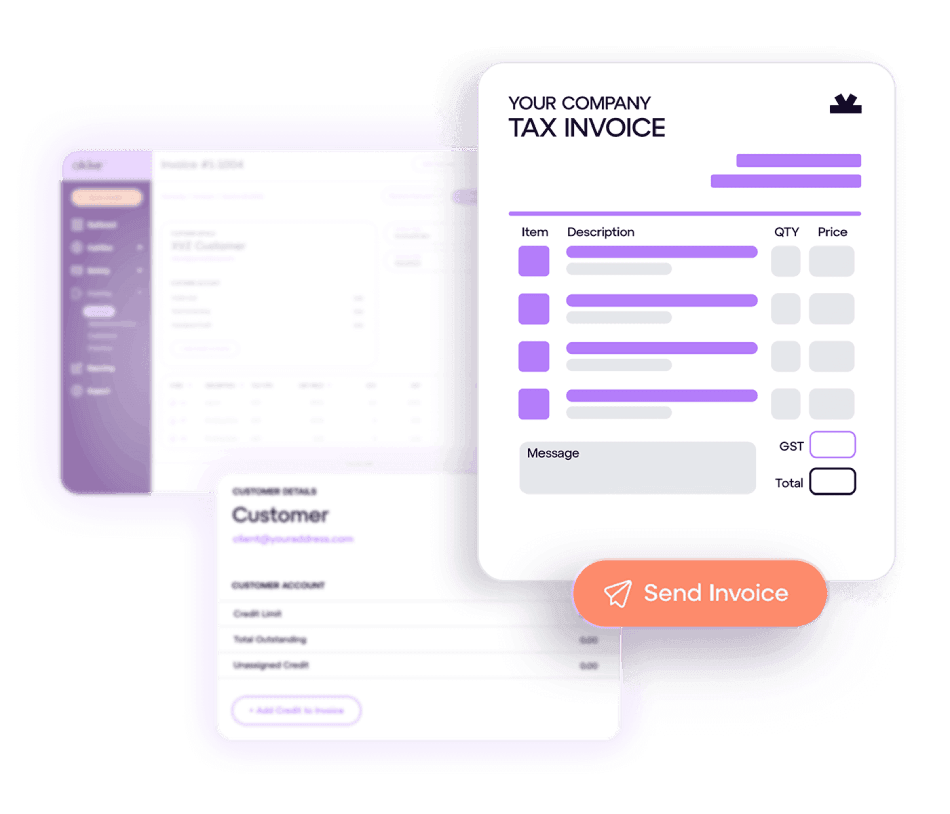

- Send invoices and quotes Unlimited

- Track income and expenses Unlimited

- Manage your customers Unlimited

- Automatic payment reminders

- Connect your bank accounts

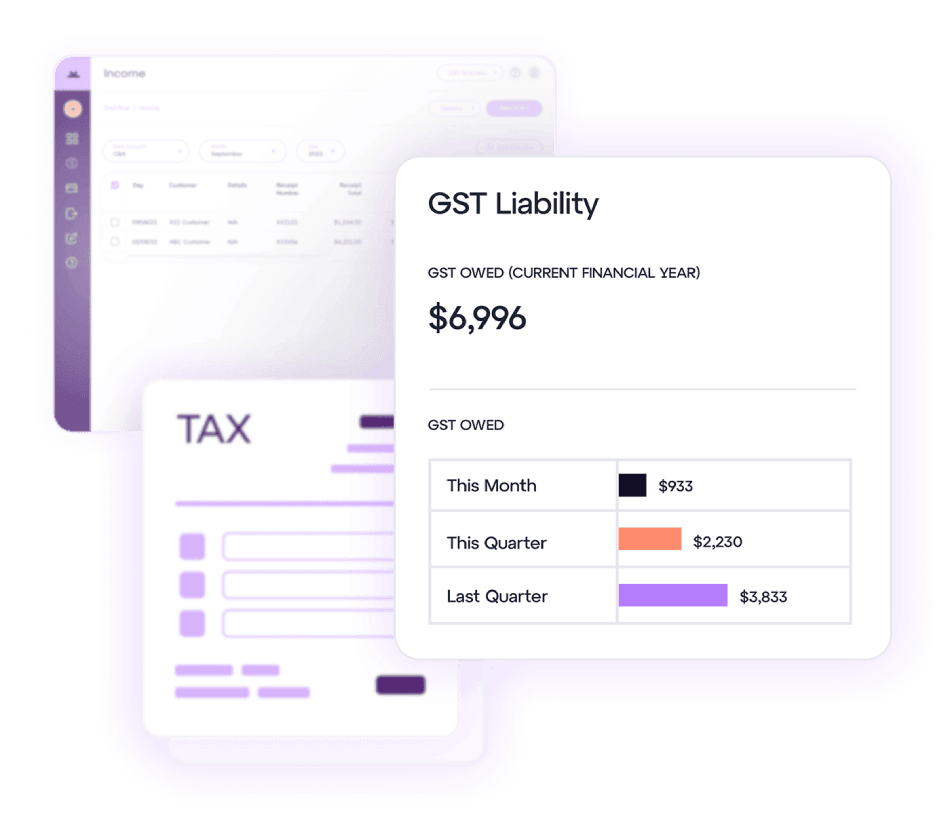

- Tax and GST tracking

- Business reports and insights

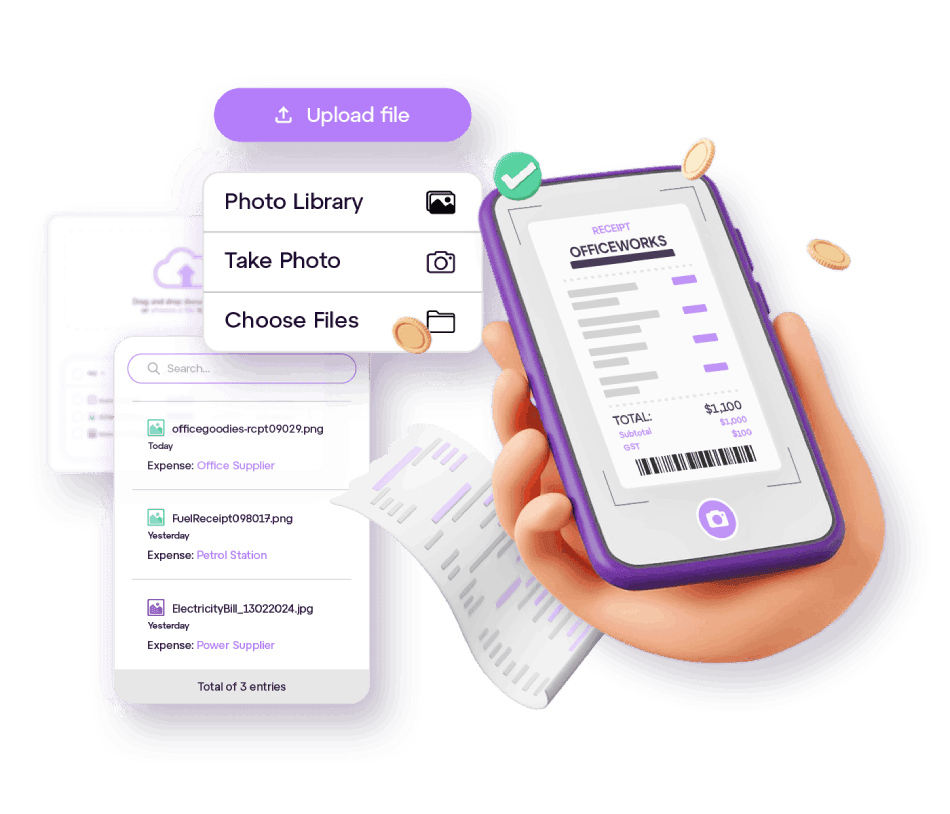

- Keep digital copies of your receipts

Key features:

- Send invoices and quotes Unlimited

- Track income and expenses Unlimited

- Manage your customers Unlimited

- Automatic payment reminders

- Connect your bank accounts

- Tax and GST tracking

- Business reports and insights

- Keep digital copies of your receipts

Join 4000+ Aussies that have trusted okke

Frequently asked questions

Frequently asked questions

Want to stay in the loop?

Sign up to get our non-annoying email updates.